Payroll tax calculator massachusetts

Massachusetts Payroll Calculators Calculate your Massachusetts net pay or take home pay by entering your pay information W4 and Massachusetts state W4 information. Ad Compare This Years Top 5 Free Payroll Software.

Quarterly Tax Calculator Calculate Estimated Taxes

Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

. Get Started With ADP Payroll. For 2022 the wage base limit for social security contributions is 147000. Ad Process Payroll Faster Easier With ADP Payroll.

Massachusetts Massachusetts Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent. Discover ADP Payroll Benefits Insurance Time Talent HR More. Discover ADP Payroll Benefits Insurance Time Talent HR More.

This free user friendly payroll calculator will certainly calculate. Plug in the amount of money youd like to take home. Free Unbiased Reviews Top Picks.

To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. Massachusetts Hourly Paycheck Calculator Results Below are your Massachusetts salary paycheck results.

Below are your Massachusetts salary paycheck results. Note that you can claim a tax credit of up to 54 for paying your Massachusetts. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Medicare contributions do not have any maximum cap on applicable income. The amount of federal and Massachusetts income tax withheld for the prior year.

Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate. Paycheck Results is your. Massachusetts Gross-Up Calculator Change state Use this Massachusetts gross pay calculator to gross up wages based on net pay.

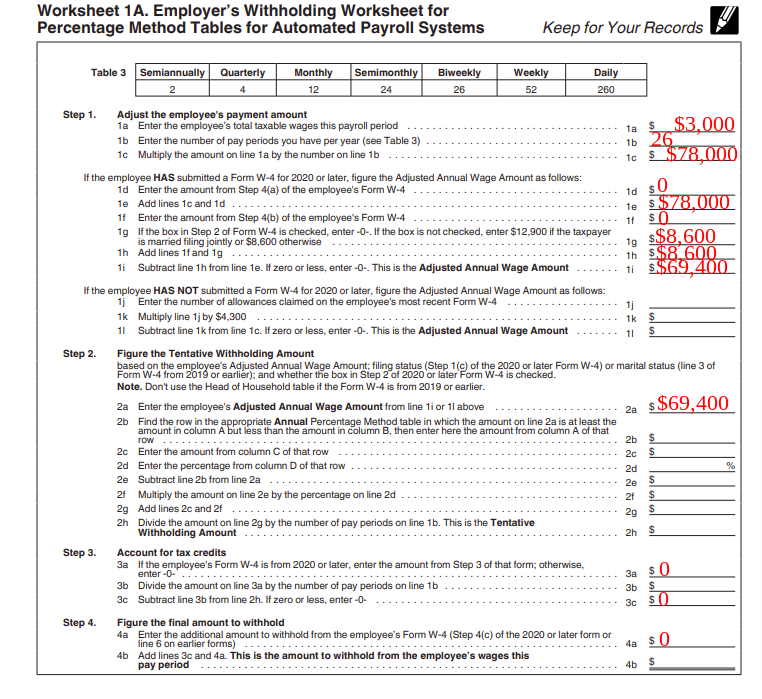

Simply enter their federal and state W-4. Ad Process Payroll Faster Easier With ADP Payroll. Our quick payroll calculator will help you physique out the federal payroll tax withholding for both your staff and your company.

Payroll Tax Salary Paycheck Calculator Massachusetts Paycheck Calculator Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or. The tax rate is 6 of the first 7000 of taxable income an employee earns annually. Free Unbiased Reviews Top Picks.

The results are broken up into three sections. Ad Compare This Years Top 5 Free Payroll Software. Your average tax rate is 1198 and your.

Paycheck Results is your gross pay and specific deductions from your paycheck. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts. Massachusetts Income Tax Calculator 2021 If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Get Started With ADP Payroll. Get Started Today with 2 Months Free.

After a few seconds you will be provided with a full. For example if an employee receives 500 in take-home. The results are broken up into three sections.

All Services Backed by Tax Guarantee. Contacting the Department of Unemployment Assistance to fulfill obligations for state. Additionally high income earners above.

Get Your Quote Today with SurePayroll.

Irs State Tax Calculator 2005 2022

Are My Workers Comp Benefits Taxable In Massachusetts

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Massachusetts Hourly Paycheck Calculators All States Ma Hourly Payroll Paycheck Calculators

Quarterly Tax Calculator Calculate Estimated Taxes

How To Calculate Payroll Taxes Methods Examples More

Calculate Sales Tax On Car Outlet 59 Off Www Ingeniovirtual Com

Quarterly Tax Calculator Calculate Estimated Taxes

Bonus Calculator Percentage Method Primepay

Federal Income Tax Rate Calculator Sale 55 Off Www Wtashows Com

Tip Tax Calculator Payroll For Tipped Employees Onpay

Quarterly Tax Calculator Calculate Estimated Taxes

How To Calculate Payroll Taxes Methods Examples More

Tip Tax Calculator Payroll For Tipped Employees Onpay

How To Calculate Payroll Taxes Methods Examples More

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator